Stock Donations

Gift Stocks to Support WCC's Mission

Efficient Giving

One of the reasons WCC has made stock donation available is the popularity of stocks as a viable monetary option. For some, this might be the best or only way to give.

Giving stocks is also one of the most tax-efficient ways to give. In the event your stock appreciates and you decide to sell it to liquidate it into cash and then give from that, you are required to pay capital gains tax. However, when you donate a stock to a non-profit, you avoid that capital gains tax. This means you can save up to 20% of tax by donating stock rather than cash made from selling the stock.

How To Give Stock

Considering Other Donation Options?

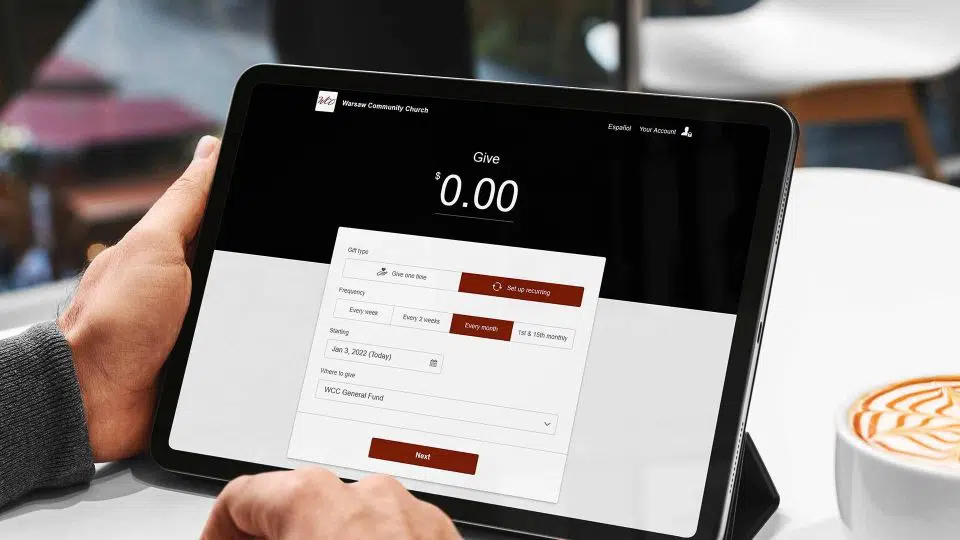

Online or Mobile

The most flexible way to give at WCC, digital giving allows you to schedule a recurring or one-time gift charged to your credit/debit card or checking account. You can easily and securely manage your giving amount and specify where the funds should be applied. Click here to give online.

At the Church

Offering boxes are available at the back of WCC’s auditorium to place a check or cash at any time. If you would like an offering envelope to include with your donation, please stop by the Info Center. These envelopes can also be mailed to WCC.

Automatic Bank Pay

You can set up automatic payment through your checking or savings account. Simply log on to your individual bank account’s online banking site and follow your bank's instructions to set up WCC as a new payee.

Contribution of Property

WCC may accept approved gifts of stocks, bonds, precious metals, vehicles, or any other assets that you would like to donate to WCC. Questions about our policy may be directed to our Controller at 574.268.0188.